Mexico News Daily – Move over Valle de Guadalupe, there’s a new wine region in town

In Mexico News Daily, Diana Serratos highlights the emergence of Puebla and Hidalgo (central Mexico) as new wine regions challenging the dominance of Valle de Guadalupe. While Baja’s wine reputation remains strong, small wineries in Puebla and Hidalgo are quietly establishing vineyards amid volcanic soils and historic terroirs. Among the standouts: Bodega Entreerres, Santo Domingo, Casa Miguel Hernández, and Tierra y Almas — the latter producing still wines (Cabernet, Malbec, etc.) and even sparkling wines in the style of Cava. These regions are gradually gaining attention and tourists, especially given their proximity to Mexico City. From the article:

While it might seem unlikely, the central states of Puebla and Hidalgo have been on the map of Mexican wine-producing states for several years. Puebla began producing wine around 17 years ago, and though this may seem relatively recent, records from Spain indicate that this area once produced high-quality grapes and wheat during the Colonial period, eventually suffering from the royal edicts that prohibited wine in the 14th and 15th centuries.

So neither of these is in the wine Goldilocks Zone of between 30° and 50° latitude. Puebla is at 19.0° and Hidalgo is at 20.5°. Not quite sure what the quality will be here. But I do want to try some of these and see what they are all about.

Wine-Searcher – The World’s Best Malbecs of 2025

In Wine-Searcher, Nat Sellers crowns Argentina’s Mendoza region as the undisputed global capital of Malbec. Despite the grape’s French origins in Cahors, every wine on the publication’s 2025 Top 10 Malbecs list hails from Argentina—led by the powerhouse estates Familia Zuccardi and Catena Zapata, which together account for seven of the ten wines ranked. The piece traces Malbec’s journey from 19th-century French import to 1990s revival, crediting figures like Paul Hobbs and Jorge Catena for transforming the varietal into Argentina’s signature red. The least expensive is $100. Here is the list, with links to buy it.

| Rank | Wine | Score | Price (USD) |

| 1 | Familia Zuccardi Finca Piedra Infinita Gravascal | 97 | $248 (Link) |

| 2 | Familia Zuccardi Finca Piedra Infinita Supercal | 97 | $275 (Link) |

| 3 | Bodega Catena Zapata Adrianna Vineyard Mundus Bacillus Terrae | 96 | $259 (Link) |

| 4 | Familia Zuccardi Finca Piedra Infinita | 96 | $156 (Link) |

| 5 | Catena Zapata Adrianna Vineyard River Stones Malbec | 95 | $185 (Link) |

| 6 | El Enemigo As Bravas Malbec | 96 | $100 (Link) |

| 7 | Familia Zuccardi Finca Cerrilladas | 96 | $115 (Link) |

| 8 | Bodega Noemía Malbec (Río Negro, Patagonia) | 95 | $168 (Link) |

| 9 | Viña Cobos Malbec | 95 | $229 (Link) |

| 10 | Catena Zapata Adrianna Vineyard Fortuna Terrae Malbec | 95 | $125 (Link ) |

All prices are in US dollars and represent the global average retail price. The critic scores are also aggregated from Wine-Searcher’s pool of critics, with some given more weight than others.

Wein.Plus – When nobody wants to become a winemaker anymore

In Wein.plus Magazine, Raffaella Usai examines a looming crisis in European viticulture: countless family wineries are struggling to find successors willing to take over the land, and many are on the brink of collapse. Shrinking margins, volatile markets, and declining appeal of agricultural life are driving a generational exodus. In Germany alone, 50–60% of winegrowing families face bankruptcy soon. Meanwhile in France, 56% of growers are over 55 years old, and only 12% are under 40. The result? Vineyards are being abandoned, steep slopes fall into disuse, and heritage landscapes risk fading away. From the Article:

The situation is serious, the mood is low. Even the greatest optimists have now realised that this is not a temporary consumer crisis, but that viticulture is undergoing a structural change. Too much wine, too little demand. The equation is simple. But what can be done? The proposals put forward by EU politicians to rebalance wine production can be counted on one hand: Grubbing up, crisis distillation, green harvesting, dealcoholisation. But will this solve the problems in the long term? Not likely.

Thomas Schaurer is a winegrower and founder of the association “Zukunftsinitiative Deutscher Weinbau”. He says clearly: “In a few months, 50 to 60 per cent of all winegrowing families in Germany are threatened with bankruptcy. What will happen if our vineyards disappear? Then we will not only lose a cultural asset that is thousands of years old—but also a piece of our homeland. What remains is overgrown, fallow land.”

Grapes are no longer worth anything, frustrated winegrowers write on social media. For many, viticulture has long been more of an occupational therapy than an economic basis.

CBC – The U.S. trade war uncorked a surprising boom for wineries across Canada

In CBC Radio’s Cost of Living, Catherine Zhu reports that a U.S. trade war has unintentionally triggered a boom for Canadian wineries. After the Trump administration imposed 25% tariffs on nearly all Canadian goods, several provinces—including Ontario, B.C., Quebec, and Alberta—responded by banning U.S. alcohol imports. The move sparked a nationwide “Buy Canadian” movement, with domestic wine sales surging across every channel. In Ontario, sales jumped 78%, while Quebec saw a 58% rise in locally made wine purchases. Wineries expanded staffing, restaurants added Canadian wines, and producers from Niagara to the Okanagan enjoyed a renaissance in local pride and tourism. From the Article:

The industry’s long-term goal? To claim 51 per cent of the domestic market. But reaching that benchmark will require more than consumer goodwill, he said.

For decades, interprovincial trade barriers have hampered the wine industry’s growth — but that may soon change.

Ten provinces and one territory have signed an agreement on direct-to-consumer sales of alcoholic beverages for personal consumption, agreeing to remove barriers preventing their alcohol from being sold in other provincial jurisdictions by May 2026.

“One of the great things that we’re hoping … is that you can go into downtown Toronto and be able to get an Okanagan red, or a Tidal Bay wine from Nova Scotia,” Taylor said.

“Because believe it or not, in many cases, a wine from another province is treated like an import.”

Château des Bachelards in Fleurie, France

Founded by Benedictine monks in the 12th century and now guided by sustainability-driven ownership, Château des Bachelards redefines Beaujolais with biodynamic old-vine Gamay and refined, age-worthy cuvées.

The 2017 Domaine Dupré Goujon Saint-Lager “Rose” Gamay offers a strikingly mineral-driven expression of Beaujolais, where graphite, slate, and cedar mingle with ripe black fruits. Structured and full-bodied, it highlights the more serious side of Gamay.

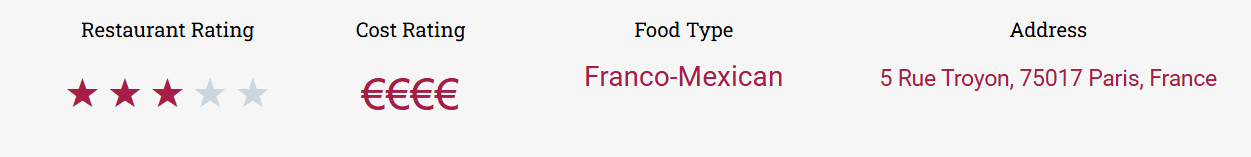

OXTE Restaurant in Paris, France

Steps from the Arc de Triomphe, OXTE pairs chef Enrique Casarrubias’ Mexican roots with polished French technique, earning one MICHELIN star and a reputation for vibrant, precise cooking.